November 10, 2023

Boyd Group Services Inc. Reports Third Quarter 2023 Results

- Consistent sales growth provides improvement in operating expense leverage -

Not for distribution to U.S. newswire services or for dissemination in the United States

Winnipeg, Manitoba – November 10, 2023 – Boyd Group Services Inc. (TSX: BYD.TO) (“BGSI”, “the Boyd Group”, “Boyd” or “the Company”) today announced the results for the three and nine month period ended September 30, 2023. The Boyd Group’s third quarter 2023 financial statements and MD&A have been filed on SEDAR+ (www.sedarplus.ca). This news release is not in any way a substitute for reading Boyd’s financial statements, including notes to the financial statements, and Boyd’s Management’s Discussion & Analysis.

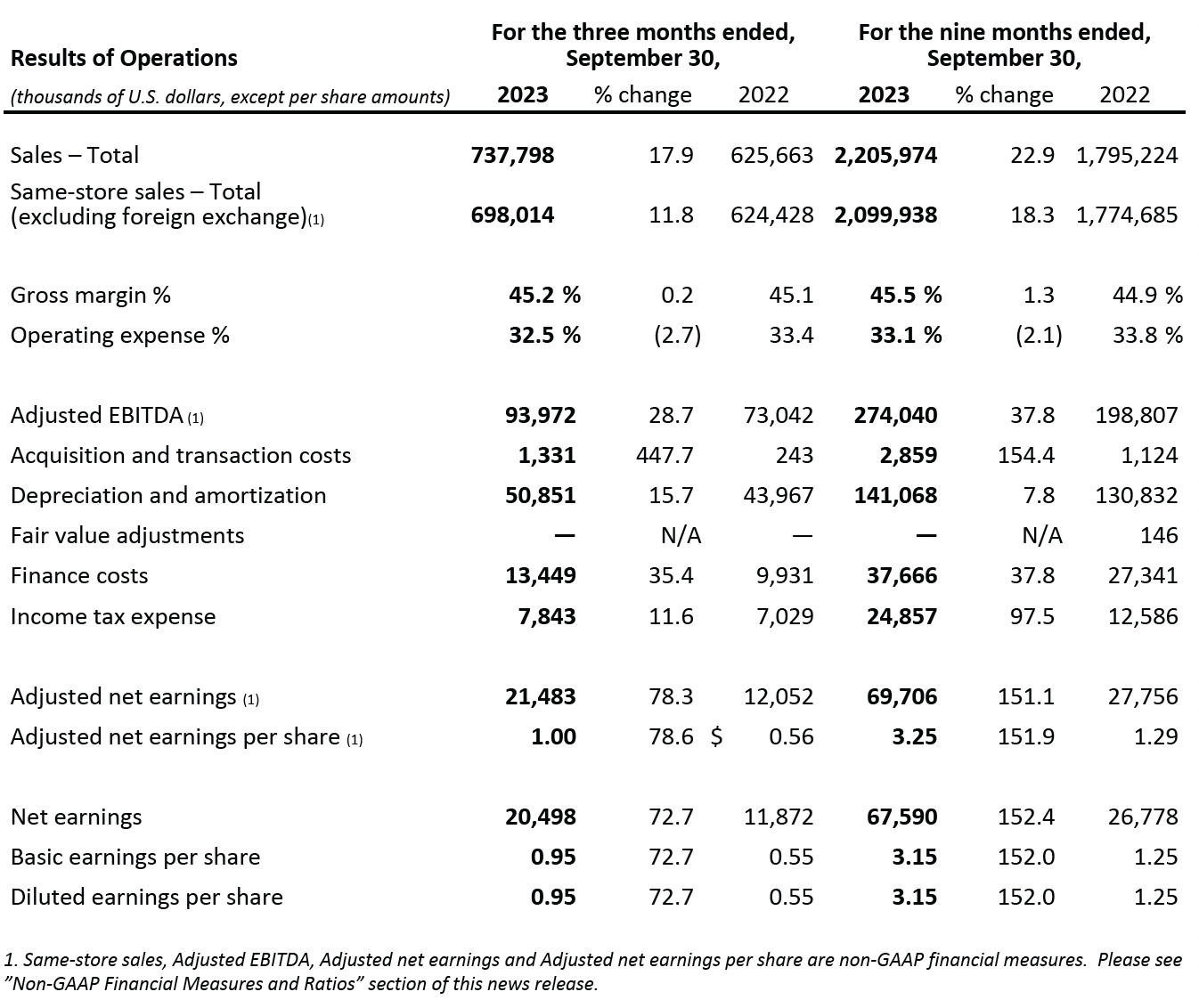

Results and Highlights for the Third Quarter Ended September 30, 2023:

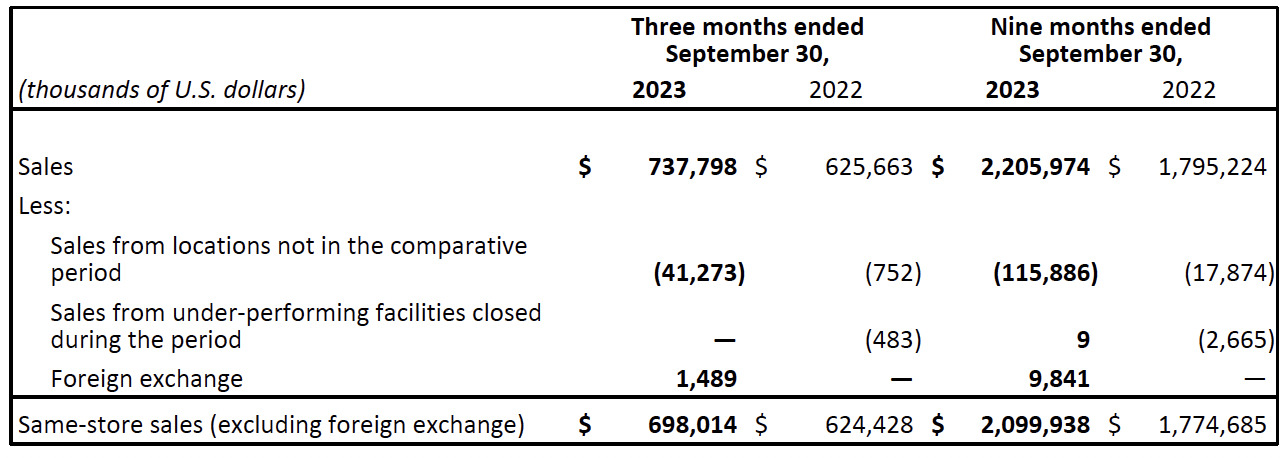

- Sales increased by 17.9% to $737.8 million from $625.7 million in the same period of 2022, including same-store sales increases of 11.8%. The third quarter of 2023 recognized one less selling and production day when compared to the same period of 2022, which decreased selling and production capacity by approximately 1.6%

- Gross Profit increased by 18.3% to $333.8 million or 45.2% of sales from $282.3 million or 45.1% of sales in the same period in 2022

- Adjusted EBITDA1 increased 28.7% to $94.0 million, or 12.7% of sales, compared with Adjusted EBITDA of $73.0 million, or 11.7% of sales in the same period of 2022

- Adjusted net earnings1 increased to $21.5 million, compared with $12.1 million in the same period of 2022 and adjusted net earnings per share1 increased to $1.00, compared with $0.56 in the same period of 2022

- Net earnings increased to $20.5 million, compared with $11.9 million in the same period of 2022 and net earnings per share increased to $0.95, compared with $0.55 in the same period of 2022

- Debt, net of cash before lease liabilities increased from $316.9 million at June 30, 2023 to $356.8 million at September 30, 2023

- Declared third quarter dividend in the amount of C$0.147 per share

- Added 21 collision repair locations, including 17 through acquisition and four start-up locations

1 Same-store sales, Adjusted EBITDA, Adjusted net earnings and Adjusted net earnings per share are non-GAAP financial measures and ratios and are not standardized financial measures under International Financial Reporting Standards and might not be comparable to similar financial measures disclosed by other issuers. For additional details, including a reconciliation of each non-GAAP financial measure to its nearest GAAP equivalent, please see ”Non-GAAP financial measures and ratios” section of this news release.

Subsequent to Quarter End

- Added nine collision repair locations, including six through acquisition and three start-up locations

- Announced a dividend increase of 2.0% to $0.600 per share annualized from $0.588 per share annualized

“We are pleased with the results reported in the third quarter of 2023, which continue to show increased same-store sales and steady growth of single locations”, said Timothy O’Day, President & Chief Executive Officer of the Boyd Group. “Gross margin improved in the third quarter of 2023 when compared to the same period of the prior year, but reduced slightly when compared to the second quarter of 2023 due to seasonal vacations”, added Mr. O’Day. “Improvement in operating expense leverage resulted in consistent Adjusted EBITDA margin when comparing the second and third quarters of 2023.”

Outlook

“Boyd continues to execute on its growth strategy. During 2023, the Company has added 78 single locations, while at the same time achieving same-store sales increases of 18.3% for the year thus far”, said Mr. O’Day. “While quarterly same-store sales increases have tapered from those experienced during the period following the pandemic and pandemic related disruptions, over the past five and ten year periods, the Company has posted average quarterly same-store sales increases of 6.7% and 5.9% respectively. Thus far in the fourth quarter, same-store sales increases are lower than what was experienced in the third quarter of 2023, but remain ahead of the average five year level of same-store sales growth.”

“Although productive capacity continues to impact sales levels that can be achieved, workforce initiatives have had a positive impact and ongoing investments in technology, equipment and training position the Company well for continued operational execution”, continued Mr. O’Day. “Client pricing increases resulted in improvement in labor margins; however, margins remain below historical levels. This remains a key area of focus for the Company, impacting both the gross margin percentage and Adjusted EBITDA margin percentage that can be achieved in the short term.”

“The United Auto Workers strike did not impact Boyd’s ability to source parts required to complete collision repairs during the third quarter of 2023. Despite the tentative settlements underway, the duration of the strike has resulted in modest delays in the supply of certain parts, and therefore the completion of a small number of repairs during the fourth quarter thus far”, said Mr. O’Day.

“The pipeline to add new locations and to expand into new markets is robust. Boyd has made investments in resources to support growth through single locations, multi-location businesses, or a combination of single and multi-location businesses, giving the Company flexibility on how best to grow. Operationally, we are focused on optimizing performance of new locations, as well as scanning and calibration services, and consistent execution of the WOW Operating Way. Given the high level of location growth in 2021, the strong same-store sales growth during 2022, and the combination of same-store sales growth and location growth thus far in 2023, we remain confident that the Company is on track to achieve its long-term growth goals, including doubling the size of the business on a constant currency basis from 2021 to 2025 against 2019 sales.”

2023 Third Quarter Conference Call & Webcast

As previously announced, management will hold a conference call on Friday, November 10, 2023, at 10:00 a.m. (ET) to review the Company’s 2023 third quarter results. You can join the call by dialing 888-390-0546 or 416-764-8688. To join the conference call without operator assistance, you may register and enter your phone number at https://emportal.ink/3Mbh9Vw to receive an instant automated call back. A live audio webcast of the conference call will be available through www.boydgroup.com. An archived replay of the webcast will be available for 90 days. A taped replay of the conference call will also be available until Friday, November 17, 2023, at midnight by calling 888-390-0541 or 416-764-8677, replay entry code 114778#, reference number 07114778.

About Boyd Group Services Inc.

Boyd Group Services Inc. is a Canadian corporation and controls The Boyd Group Inc. and its subsidiaries. Boyd Group Services Inc. shares trade on the Toronto Stock Exchange (TSX) under the symbol BYD.TO. For more information on The Boyd Group Inc. or Boyd Group Services Inc., please visit our website at https://www.boydgroup.com.

About The Boyd Group Inc.

The Boyd Group Inc. (the “Company”) is one of the largest operators of non-franchised collision repair centres in North America in terms of number of locations and sales. The Company operates locations in Canada under the trade names Boyd Autobody & Glass (https://www.boydautobody.com) and Assured Automotive (https://www.assuredauto.ca) as well as in the U.S. under the trade name Gerber Collision & Glass (https://www.gerbercollision.com). In addition, the Company is a major retail auto glass operator in the U.S. with operations under the trade names Gerber Collision & Glass, Glass America, Auto Glass Service, Auto Glass Authority and Autoglassonly.com. The Company also operates a third party administrator, Gerber National Claims Services (“GNCS”), that offers glass, emergency roadside and first notice of loss services. For more information on The Boyd Group Inc. or Boyd Group Services Inc., please visit our website at (https://www.boydgroup.com).

Non-GAAP Financial Measures and Ratios

Same-store sales, Adjusted EBITDA, Adjusted net earnings and Adjusted net earnings per share are non-GAAP financial measures. Boyd’s management uses certain non-GAAP financial measures to evaluate the performance of the business and to reward employees. These non-GAAP financial measures are not defined in International Financial Reporting Standards (“IFRS”) and should not be considered an alternative to net earnings or sales in measuring the performance of BGSI.

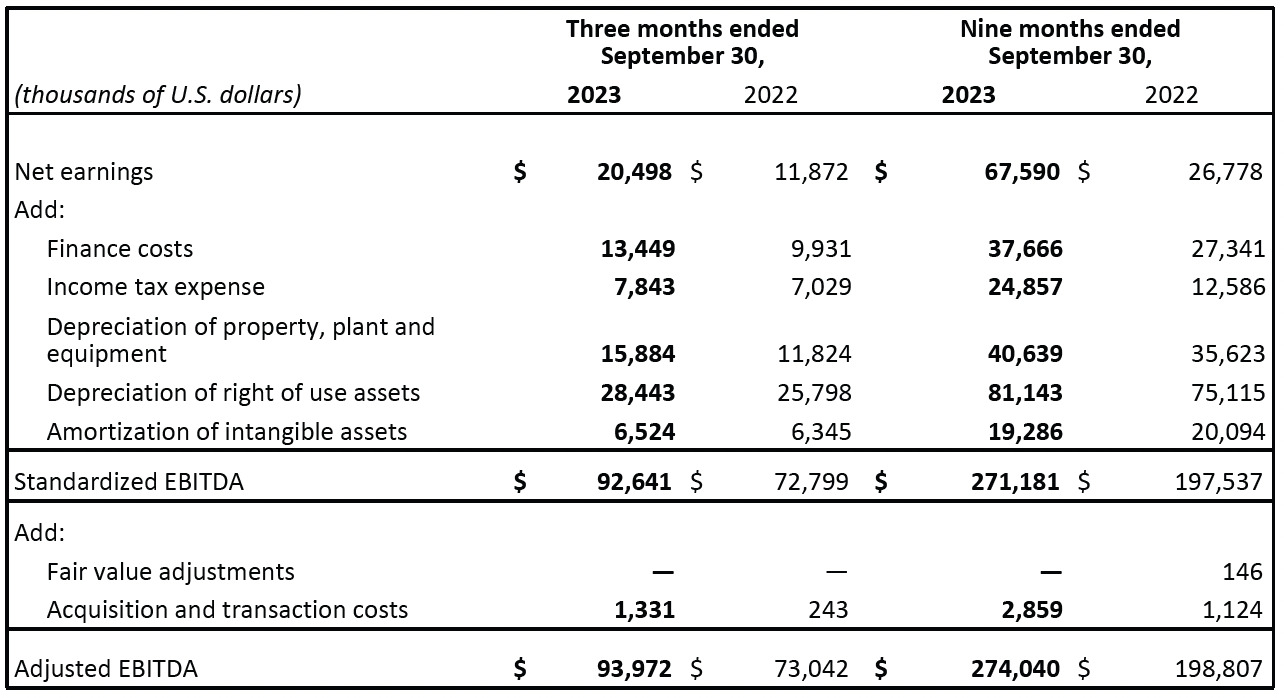

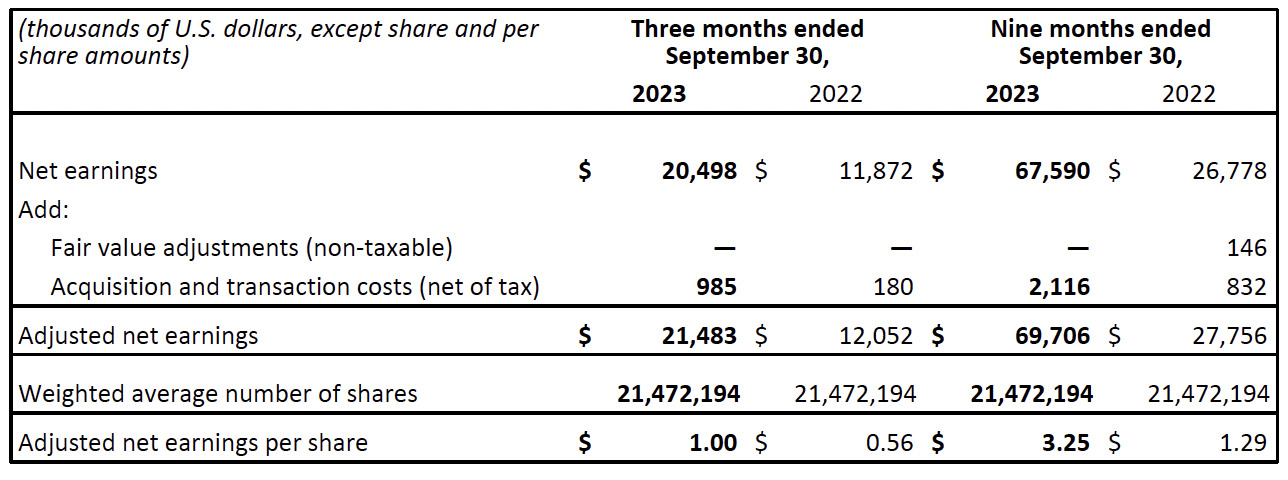

The following is a reconciliation of BGSI’s non-GAAP financial measures and ratios:

ADJUSTED EBITDA

Standardized EBITDA and Adjusted EBITDA are measures commonly reported and widely used by investors and lending institutions as an indicator of a company’s operating performance and ability to incur and service debt, and as a valuation metric. They are also key measures that management uses to evaluate performance of the business and to reward its employees. While EBITDA is used to assist in evaluating the operating performance and debt servicing ability of BGSI, investors are cautioned that EBITDA and Adjusted EBITDA as reported by BGSI may not be comparable in all instances to EBITDA as reported by other companies.

ADJUSTED NET EARNINGS

BGSI believes that certain users of financial statements are interested in understanding net earnings excluding certain fair value adjustments and other items of an unusual or infrequent nature that do not reflect normal or ongoing operations of the Company. This can assist these users in comparing current results to historical results that did not include such items.

SAME-STORE SALES

Same-store sales is a non-GAAP measure that includes only those locations in operation for the full comparative period. Same-store sales is presented excluding the impact of foreign exchange fluctuation on the current period.

For further information, please contact:

|

Timothy O’Day Jeff Murray |

Craig MacPhail |

Caution concerning forward-looking statements

Statements made in this press release, other than those concerning historical financial information, may be forward-looking and therefore subject to various risks and uncertainties. Some forward-looking statements may be identified by words like “may”, “will”, “anticipate”, “estimate”, “expect”, “intend”, or “continue” or the negative thereof or similar variations. Readers are cautioned not to place undue reliance on such statements, as actual results may differ materially from those expressed or implied in such statements. Factors that could cause results to vary include, but are not limited to: employee relations and staffing; margin pressure and sales mix changes; acquisition risk; operational performance; brand management and reputation; market environment change; reliance on technology; supply chain risk; pandemic risk & economic downturn; changes in client relationships; decline in number of insurance claims; environmental, health and safety risk; climate change and weather conditions; competition; access to capital; dependence on key personnel; tax position risk; corporate governance; increased government regulation and tax risk; fluctuations in operating results and seasonality; risk of litigation; execution on new strategies; insurance risk; interest rates; U.S. health care costs and workers compensation claims; foreign currency risk; low capture rates; capital expenditures; and energy costs and BGSI’s success in anticipating and managing the foregoing risks.

We caution that the foregoing list of factors is not exhaustive and that when reviewing our forward-looking statements, investors and others should refer to the “Risk Factors” section of BGSI’s Annual Information Form, the “Risks and Uncertainties” and other sections of our Management’s Discussion and Analysis of Operating Results and Financial Position and our other periodic filings with Canadian securities regulatory authorities. All forward-looking statements presented herein should be considered in conjunction with such filings.

Boyd Group Services Inc.

1745 Ellice Avenue

Winnipeg, Manitoba, R3H 1A6

Email: info@boydgroup.com

Tel: 204-895-1244

Fax: 204-895-1283